tempe az sales tax rate 2020

Groceries and prescription drugs are exempt from the Arizona sales tax. There is no applicable special tax.

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Not Taxed By State County MCTC Section 445.

. Monday - Friday 8am - 5pm. Apply for TPT License. The sales tax jurisdiction name is Arizona which may refer to a local government divisionYou can print a 87 sales tax table hereFor tax rates in other cities see Arizona sales taxes by city and county.

File Pay TPT Monthly AZTaxesgov. When the sales tax is greater. Exact tax amount may vary for different items.

Arizona has recent rate changes Wed Jan 01 2020. Sales tax in Tempe Arizona is currently 81. You can print a 86 sales tax table here.

If this rate has been updated locally please contact us and we will update the sales tax rate for Tempe Arizona. For tax rates in other cities see Arizona sales taxes by city and county. This resource can be used to find the transaction privilege tax rates for any location within the State of Arizona.

Select the Arizona city from the list of popular cities below to see its current sales tax rate. The Mesa sales tax rate is. The 86 sales tax rate in Phoenix consists of 56 Arizona state sales tax 07 Maricopa County sales tax and 23 Phoenix tax.

Wayfair Inc affect Arizona. Office Address Mailing Address. Did South Dakota v.

The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. The County sales tax rate is. Did South Dakota v.

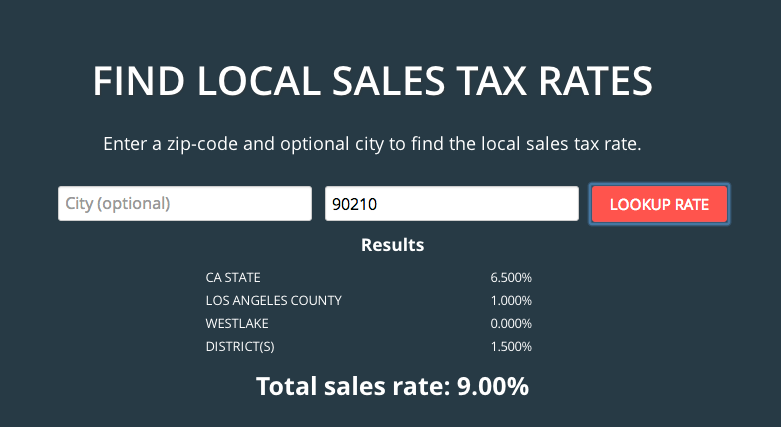

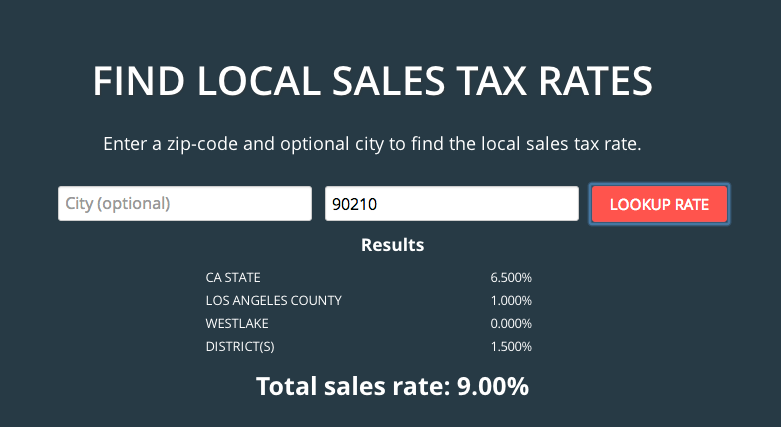

Use the physical address or the zip code or if it is unknown the Map Locator link can be used to find the location. There is no applicable special tax. What is the sales tax rate in Tempe Arizona.

The Arizona sales tax rate is currently. ATRA is the most respected independent and accurate source of public finance and tax policy in Arizona. The TPT is Arizonas version of a sales tax.

Title 42 Chapter 5 Article 10 with collecting the excise tax imposed only by the state and transaction privilege tax state counties and cities imposed on adult use marijuana sales. The Arizona sales tax rate is currently. 2022 Arizona state sales tax.

At least one local transaction privilege tax TPT rate change took effect in Arizona on January 1 2019. For states that have a tax rate that is less than Arizonas 56 tax is collected by the state of Arizona at the time of purchase. The County sales tax rate is.

ATRA is nonprofit and nonpartisan. The 81 sales tax rate in Tempe consists of 56 Arizona state sales tax 07. 6 rows The Tempe Arizona sales tax is 810 consisting of 560 Arizona state sales tax and.

For tax rates in other cities see Puerto Rico sales taxes by city and county. The minimum combined 2022 sales tax rate for Tempe Arizona is. As of 2020 the current county sales tax rates range from 025 to 2.

The sales tax rate for Tempe was updated for the 2020 tax year this is the current sales tax rate we are using in the Tempe Arizona Sales Tax Comparison Calculator for 202223. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. The Arizona Department of Revenue ADOR is tasked in ARS.

The sales tax rate for Tempe was updated for the 2020 tax year this is the current sales tax rate we are using in the Tempe Arizona Sales Tax Comparison Calculator for 202223. Arizona Tax Rate Look Up Resource. City of Tempe except City holidays Tax and License.

6th St 3rd Floor. No School No School. The current total local sales tax rate in Tempe.

You can print a 81 sales tax table here. Tempe in Arizona has a tax rate of 81 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tempe totaling 25. The Tempe sales tax rate is.

There is no applicable special tax. The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. With local taxes the total sales tax rate is between 5600 and 11200.

The rate imposed is equal to the state rate where the car will be registered. The minimum combined 2022 sales tax rate for Mesa Arizona is. This is the total of state county and city sales tax rates.

4 rows Tempe Junction AZ Sales Tax Rate. This is the total of state county and city sales tax rates. Tempe AZ 85280 salestaxtempegov.

The state sales tax rate in Arizona is 5600. Tempe Tax License. Instead of taxing the transaction or sale it taxes the vendor for the privilege of doing business in the state.

Average Sales Tax With Local. Arizona has state sales tax of 56 and. Wayfair Inc affect Arizona.

The 81 sales tax rate in Tempe consists of 56 Puerto Rico state sales tax 07 Maricopa County sales tax and 18 Tempe tax.

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Is Food Taxable In Arizona Taxjar

Arizona Sales Tax Small Business Guide Truic

Valley Cities Affordability And Homeowner S Comparisons City Of Mesa

Residential Commercial Rentals City Of Tempe Az

Plano Commits Not To Raise Property Tax Rate As City Faces Tight Budget Season Community Impact

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

How To Collect Sales Tax Through Square Taxjar

What S The Arizona Tax Rate Credit Karma Tax

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Arizona Sales Tax Small Business Guide Truic

2021 Arizona Car Sales Tax Calculator Valley Chevy

Arizona Sales Tax Rates By City County 2022

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Valley Cities Affordability And Homeowner S Comparisons City Of Mesa